If you are applying for your first business loan you may be surprised with how much of your personal financial information is requested as part of the loan application.

Lenders will still assess your personal income, assets, and credit as part of your business loan application. Even if your business is a separate legal entity such as a corporation or an LLC. The reason for this is that most small business loans require a personal guarantee. Regardless of what happens with your business, you are still personally responsible for repaying the debt of the business.

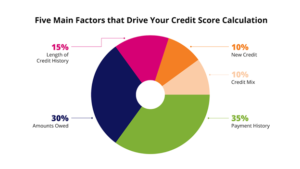

Below we break down what factors impact your credit score and tips to improve your credit to best position yourself to qualify for the financing that your business needs.

Will business lenders pull my personal credit report?

Not all business lenders report loans on your personal credit report. However, all of them will pull a personal credit report to determine if you are eligible for a loan. This is often a stumbling block for small business owners applying for a business loan.

Many new business owners start by bootstrapping. They don’t apply for their first business loan until the business is more established. They will also wait until their business is in need of capital for growth. At that time, some find that their personal credit affects their ability to qualify for a business loan. Their loan size they need to scale their business may also be impacted.

Entrepreneurs looking to start a business may have to delay their business launch to clean or strengthening their personal credit. They may even decide to start at a much smaller scale if they cannot obtain the capital they need.

How is my credit score calculated?

In addition to qualifying for credit, credit scores also influence the rates and terms of approved credit. When borrowing larger loan amounts, the rates and terms can have a significant impact on the monthly loan payment and the total interest charged over the term of the loan.

There are five main factors that drive your credit score calculation, using the data on your credit report itself:

1. Payment History

Accounts for 35% of your credit score calculation. Payment history shows how you’ve paid on your accounts in the past. Therefore, it also predicts how likely you are to make your payments in the future. Taken into consideration is your on-time and late payment history. Types of credit involve…

1) revolving credit (such as credit cards and lines of credit)

2) installment accounts (loans)

3) public records (such as a bankruptcy)

4) accounts in collections.

The impact of any late payments will depend on factors such as: How far behind did you fall on your payments? What is owed on that account? How recently did the late payment occur? What is the total late payments you have on a given account or on your credit report in general?

2. Amounts Owed

Accounts for 30% of your credit score calculation and considers: the total amount of debt you carry on your credit report, how many open accounts you have with balances, the balance on your installment loans compared to your original loan amounts, and your revolving credit utilization ratio.

In other words, how high are your balances on your credit cards and lines of credit compared to your credit limits?

If you tend to hold high balances, this will have a significant impact on your credit score. Many entrepreneurs conveniently use credit cards to cover start-up costs or for other long-term business investments such as purchasing equipment, but since these types of expenses are not typically paid off quickly, the entrepreneur’s personal credit score will be negatively impacted.

3. Length of Credit History

Accounts for 15% of your credit score calculation. In addition to the age of your oldest account, other factors that are considered are: age of your newest account, the average age of all accounts and how long it has been since using certain accounts.

4. New Credit

Accounts for 10% of your credit score calculation. Having established credit will always be looked at favorably by creditors, so having too many new accounts with limited payment history can have a slight negative impact on your score. Looking for new credit can also have an effect if you have too many recent inquiries (hard credit pulls) on your report, though pulling your own credit report will not affect your credit score.

5. Credit Mix

Accounts for 10% of your credit score calculation. Credit mix refers to the types of accounts you have on your credit report. Types of credit accounts can include: credit cards, retail cards, installment loans, and mortgages.

Having a mix demonstrates that you have experience with and can responsibly manage both revolving accounts and installment loans by making payments and maintaining a healthy credit utilization ratio – the amount of revolving credit you’re currently using divided by the total amount of revolving credit you have available.

How can I improve my credit score?

If your credit score is lower than you’d like, there are ways to improve it. Follow these five tips to boost your score:

- Make your monthly payments on time (creditors report accounts as late when the payment is 30+ days past your due date)

- Keep credit card and line of credit balances low

- Keep your oldest accounts on your credit report as active to keep a long credit history

- Do not apply for or open multiple accounts at the same time to limit how much new credit you open and how many inquiries appear on your credit

- Check your credit report at annualcreditreport.com to look for any reporting mistakes or fraudulent activity. Consumers can generally access one free credit report per year, however during the COVID-19 pandemic, you can get a free weekly credit report from all three credit agencies, Experian, Equifax, and Transunion, until April 20, 2022

Can I get a loan while establishing or rebuilding my credit score?

Yes, you can! Accessity offers small business loans with flexible credit requirements up to $100,000 and access to a business resource community to support entrepreneurs in Southern California. We provide free credit and financial coaching to our loan clients and interested loan applicants through our TrustPlus partnership. If you’d like to see if you qualify for a business loan or are interested in credit and financial coaching, contact our Accessity team here.

This information is shared for educational purposes only. Please consult legal, tax, credit, or financial experts for specific guidance.